year end tax planning letter 2021

With the assistance of your professional tax advisor figure out if you will be claiming the standard deduction or itemizing deductions in 2021. 2021 year-end financial planning letter.

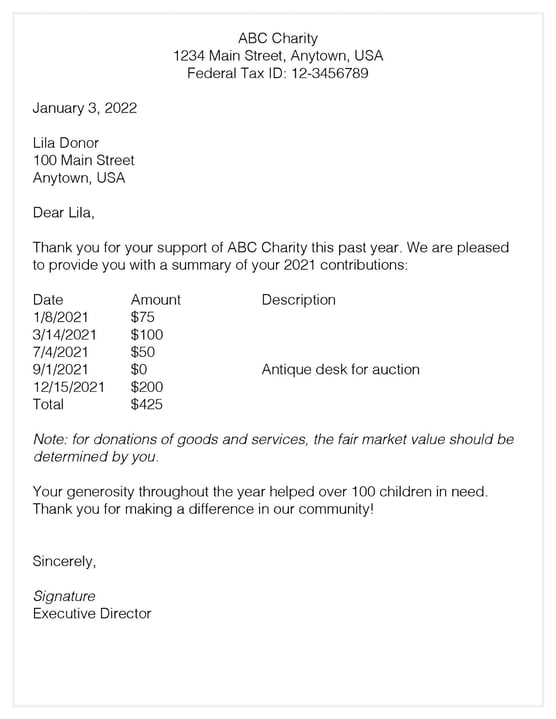

Sample Donation Receipt Template Free Documents Pdf Word Letter Donation Letter Donation Letter Template Letter Templates

Click here to download the PDF.

. Year end tax planning. For gifts made in 2021 the gift tax annual exclusion is 15000 and for 2022 is 16000. After going through such a difficult year in which.

9 Year-End Tax Planning Strategies High-Net-Worth Individuals Need to Know for 2021 November 23 2021 by Laura Sefcik. However 2021 has proven to be just as unique if not more challenging. The Year-end tax planner is designed primarily for individuals who have accumulated some wealth or own their own businesses large or small.

16 June 2021 9 months ago. Download Our 2021 Year-End Tax Planning Letter November 16 2021. Dr Mark Pizzacalla Partner BDO.

Thanks to the tireless work of scientists vaccinations are already in progress. The year-end tax-planning special report is based on the prevailing federal tax laws rules and regulations. Tax planning in 2021.

November 16 2021. 2021 Year-End Tax Planning for Individuals. While it is said history does not repeat itself sometimes its events are awfully similar.

A summary of the proposed provisions in President Bidens Build Back Better Act information regarding the 3rd round of Economic Impact Payments and Advance Child Tax Credit payments and a summary. Contributions made to a qualified retirement plan by the extended due date of the 2021 federal income tax return may be deductible for 2021. Year End Tax Letter 2021 - Beacon Pointe Advisors.

2021 Year End Letter. As we approach the midpoint of 2021 we have reason to hope that better days are ahead in the fight against COVID-19. Contributions made after this date are deductible for 2022.

Heres some key things to remember. At the end of 2021 the United States is still recovering from the COVID-19 pandemic and tax professionals are dealing with the multiple changes in the tax rules designed to help the country cope with the resulting economic impact. 2021 Year-End Tax Planning Update.

As we write this years tax letter we are reminded of our 2017 edition. The tax year-end is an important time to ensure your business and personal tax affairs are in order. Taxpayers at least age 70 and a half should consider making qualified charitable distributions QCDof up to 100000 per yeardirectly from a non-Roth.

As of 11292021 the Build Back Better BBB Act has passed the House and is pending approval by the Senate. By developing a year-end plan you can maximize the tax breaks currently on the books and avoid potential pitfalls. Required Minimum Distributions RMD RMDs have resumed for the 2021 tax year and must be taken by December 31 unless the taxpayer turned age 72 during the year which defers the start date to April 1.

Like everything else in 2021 year-end tax planning wont be status quo due to the uncertainties of a continued global pandemic and complicated and ever-changing tax laws. 11 Dog harness Pet Supplies Dog Supplies Dog Harnesses. 2021 Year End Tax Planning Tips Last minute strategies to potentially reduce your tax bill.

Last years global pandemic continued into 2021 and weve witnessed. Dear Clients and Friends With the end of the year approaching it is a good time to review your 2021 income tax situation and take steps to ensure that you are taking full advantage of the many tax planning strategies available. As of the publication date of this planning letter the 1.

Year End Tax Letter. The election of a new president in 2020 created much speculation regarding changes to tax law but. BBB Act Economic Impact Payments Etc.

Year-End Tax Planning for 2021. Year-End Tax Planning Comes with a Twist in 2021 Some of the most common strategies people use to hold their taxes down are being turned on their ears this year thanks to possible changes in tax. Of course it is subject to change especially if major tax reform provisions are enacted before the end of the year.

Thank you for downloading. Year-end tax planner 2021. Be aware that the tax-planning concepts discussed within this letter are intended only to provide an overview.

Year-End Tax Planning Letter for Individual Clients. As 2021 begins to come to a close and we head into 2022 its a great time to think about planning ahead to consider tax strategies while staying on track to meet your personal financial planning goals. 2021 year-end financial planning letter.

The results of this analysis will likely dictate your tax planning approach at the end of the year. Dear Clients Friends and Beacon Pointe Associates End of year tax planning is more difficult this year than it normally is given that we do not yet know if this year will bring changes to tax laws. Tax advisers face the difficult task of helping clients plan for next year while there are lots of unknowns.

When planning for 2021 and 2022 there are proposals from the Biden Administration to increase taxes on those making more than 40000 per year as single filers and 450000 for those who are. The November 3 draft of the Build Back Better Act does not include any changes to the estate and gift tax rules. For 2021 the unified estate and gift tax exemption and generation-skipping transfer tax exemption is 11700000 per person.

It includes nine year-end tax planning checklists and several tables of useful information. For any tax year beginning in 2021 the threshold amount is 329800 for married filing joint returns 164925 for married filing separately and 164900 for all other returns. If another new law is enacted before 2022 it may require you to revise your year-end tax planning strategies.

Upcoming CPE Webinars. In the fall of 2017 it was unclear whether the Tax Cuts and Jobs Act TCJA would be enacted. These rules should be considered in year-end tax planning along with other changes in the law and existing.

Keeping all that in mind we have prepared the following 2021 Year-End Tax Letter. Healthcare workers have gone above and beyond in helping to treat those afflicted. We thought that the 2020 tax year was unique with its challenges legislative changes and political strife.

Employers have until the extended due date of their 2021 federal income tax return to retroactively establish a qualified retirement plan and fund the plan for 2021. 2021 year-end tax letter. This is the time to assess your tax outlook for 2021.

One of the most important aspects of tax planning is to ensure all appropriate elections and choices have been made and the correct. Helping individuals and owner-managed businesses save tax.

The Kiplinger Tax Letter Stop Overpaying On Your Taxes

Donation Letters For School Donationlettertips Donation Letter Donation Request Letters Donation Letter Template

Missing A Stimulus Check Irs Letter 6475 Can Help You Claim Recovery Rebate Credit On Taxes Usa Today In 2022 Lettering Irs How To Plan

Tax Deduction Letter Pdf Templates Jotform

Irs Tax Letters Explained Landmark Tax Group

Subscribe The Kiplinger Tax Letter

Infographic End Of Year Fundraising Campaign Planning Fundraising Campaign Campaign Planning Fundraising

Pin By Tanya On Photos In Writing Payment Plan Lettering

All In One Financial Planner And Printable Bundle 15 Products 51 Pages A4 Letter Budget Planner Financial Planner Budget Planning

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Letter Of Support Sample Supportive Support Letter Lettering

2021 1040ez Form And Instructions 1040 Ez Easy Form Tax Forms Irs Tax Forms Income Tax

Fiduciary Estate Or Trust Tax Return Engagement Letter Intended For Bookkeeping Letter Of Engagement Templ Engagement Letter Letter Template Word Lettering

Subscribe The Kiplinger Tax Letter

Best Practices In Sending Year End Statements To Donors

50 Sample Engagement Letters In Pdf Ms Word Pertaining To Bookkeeping Letter Of Engagement Template Engagement Letter Letter Templates Bookkeeping Templates